Forex and S&P 500 charts. Primarily focused on Elliott Wave analysis yet all forms of technical analysis are appreciated.

Showing posts with label SPY. Show all posts

Showing posts with label SPY. Show all posts

Thursday, April 24, 2014

Tuesday, November 13, 2012

US Equity Market Rolling Over?

Tuesday, August 21, 2012

Potential S&P 500 Peak

Tuesday, February 28, 2012

Decade long S&P 500 channel resistance looming at 1382

Monday, February 6, 2012

Possible 5 waves lower in S&P 500

Friday, February 3, 2012

S&P 500 corrective rally appears complete

Thursday, December 1, 2011

S&P 500 Mid-Term Elliott Wave Count

Wednesday, November 30, 2011

S&P 500 B Wave Correction potentially complete

Wednesday, November 16, 2011

S&P 500 Triangle Consolidation Appears Complete

Wednesday, November 9, 2011

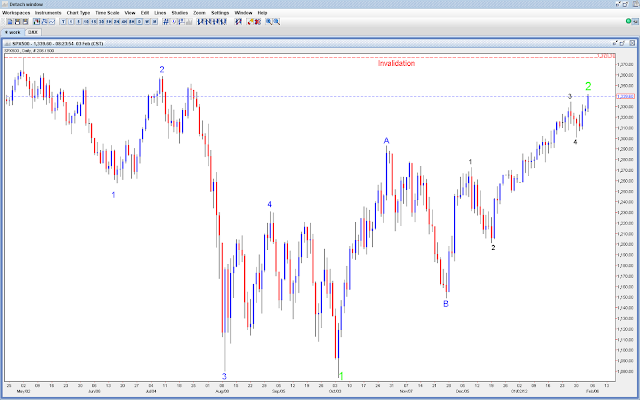

S&P 500 SHTF line

The S&P 500 has survived a test of 1225 which was already major support, but is now where the recent trendline resides. If and when this level of support is taken out, prepare for an extremely sharp long-term move lower. This should coincide with a sustained USD breakout.

|

Monday, October 3, 2011

S&P 500 ready to rally?

Thursday, September 22, 2011

S&P 500 to begin Wave 4 up?

|

| Here is my current standing in CNBC's Million Dollar Portfolio challenge. All of my trades in this portfolio are based on the research I have posted to this blog. |

Tuesday, September 20, 2011

S&P 500 Hunt Volatility Funnel & Elliott Wave Count

Friday, September 9, 2011

S&P 500 Mid Term Chart Update

Tuesday, August 30, 2011

S&P 500 Short Term Chart

Labels:

cfd,

day trading,

investing,

SPX,

SPY,

stock market

Sunday, August 28, 2011

S&P 500 Mid Term Chart

Subscribe to:

Posts (Atom)