Forex and S&P 500 charts. Primarily focused on Elliott Wave analysis yet all forms of technical analysis are appreciated.

Showing posts with label elliott wave. Show all posts

Showing posts with label elliott wave. Show all posts

Thursday, April 24, 2014

Tuesday, November 13, 2012

US Equity Market Rolling Over?

Tuesday, April 24, 2012

EURGBP Bottom in place?

Tuesday, April 3, 2012

AUDUSD Critical Juncture

Sunday, April 1, 2012

GBPJPY D Wave Complete

Thursday, March 29, 2012

AUDUSD to rally past 1.085

Wednesday, March 14, 2012

GBPJPY decline ahead?

Thursday, March 8, 2012

GBPJPY Head and Shoulders topping pattern

Wednesday, February 29, 2012

AUDUSD impulsive decline on 1 minute charts

Tuesday, February 28, 2012

NZDUSD potentially topping?

Friday, February 24, 2012

USDSEK Dual Support Convergence

Wednesday, February 22, 2012

AUDUSD Detailed look at Wave 4 Red

Tuesday, February 21, 2012

AUDUSD long opportunity to set up amazing short entry

Monday, February 6, 2012

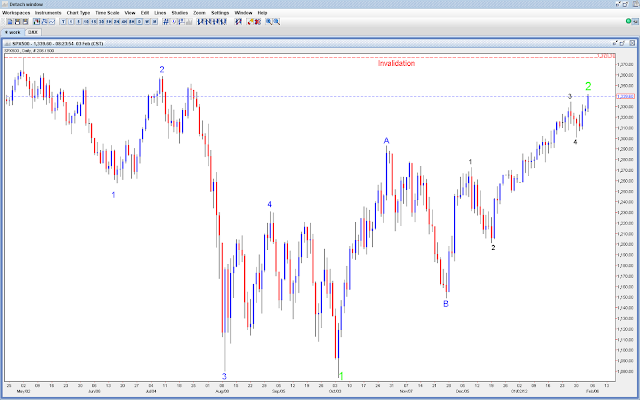

Possible 5 waves lower in S&P 500

Friday, February 3, 2012

S&P 500 corrective rally appears complete

Monday, January 23, 2012

USDCAD Daily and Weekly Wave Counts

Thursday, January 12, 2012

EURNZD - Possibly concluding 3 year impluse

Wednesday, January 11, 2012

NZDUSD Wave 2 higher potentially complete

Wednesday, January 4, 2012

EURUSD Trending Higher?

Thursday, December 15, 2011

EURCHF low risk bullish setup

Subscribe to:

Posts (Atom)