|

| NZDUSD appear to have completed Wave B Black and should above the top of Wave A Black in a wave C Black. The next wave down should be violent, so be cautious. |

Forex and S&P 500 charts. Primarily focused on Elliott Wave analysis yet all forms of technical analysis are appreciated.

Friday, September 23, 2011

NZDUSD Wave 2 bounce still underway

Thursday, September 22, 2011

AUDUSD potential for bounce?

S&P 500 to begin Wave 4 up?

|

| Here is my current standing in CNBC's Million Dollar Portfolio challenge. All of my trades in this portfolio are based on the research I have posted to this blog. |

Wednesday, September 21, 2011

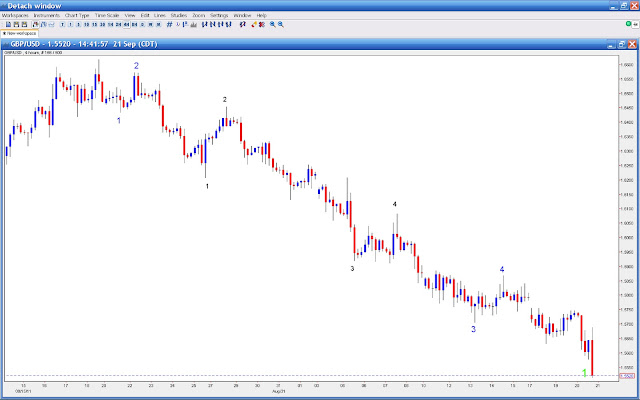

GBPUSD to bounce in Wave 2?

USDJPY finishing decade long impulse wave?

Tuesday, September 20, 2011

S&P 500 Hunt Volatility Funnel & Elliott Wave Count

Monday, September 19, 2011

Hewlitt Packard to make new highs?

Sunday, September 18, 2011

USDCAD to break above parity?

Subscribe to:

Comments (Atom)