Bryan Andre's Charts

Forex and S&P 500 charts. Primarily focused on Elliott Wave analysis yet all forms of technical analysis are appreciated.

Thursday, April 24, 2014

Sunday, February 10, 2013

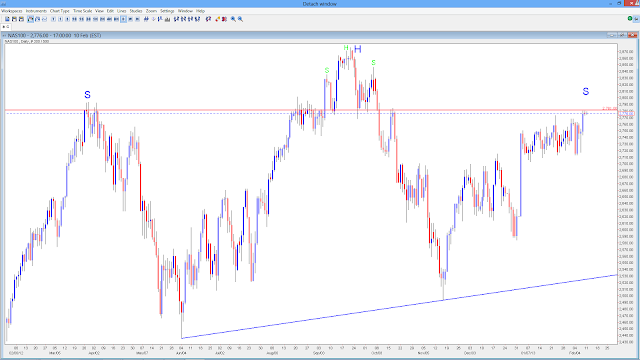

NASDAQ - Head and Shoulders

Tuesday, November 13, 2012

US Equity Market Rolling Over?

Tuesday, August 21, 2012

Potential S&P 500 Peak

Tuesday, April 24, 2012

EURGBP Bottom in place?

Monday, April 9, 2012

EURUSD - Heading higher?

Tuesday, April 3, 2012

AUDUSD Critical Juncture

Subscribe to:

Posts (Atom)